Total asset turnover is a ratio that measures the finance of a company’s efficiency in generating sales revenue from its total assets. It indicates how effectively a company utilizes its assets to generate sales.

The formula for calculating total asset turnover is:

Total Asset Turnover = Net Sales / Average Total Assets

Table of Contents

Where:

Net Sales refer to the total revenue a company generates from its primary operations after deducting any sales returns, allowances, and discounts.

Average Total Assets is the average value of a company’s total assets over a specific period, typically calculated as the average of the beginning and ending total asset values.

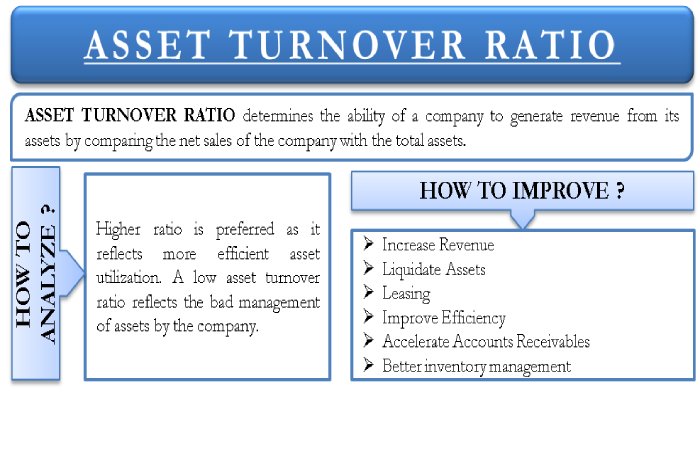

The total asset turnover ratio indicates the sales generated for each dollar invested in total assets. A higher ratio suggests better asset utilization and efficiency in generating sales, while a lower ratio may indicate poor asset management or underutilization of assets.

It’s important to note that the total asset turnover ratio interpretation can vary across industries. Comparing the ratio of a company to its industry peers or historical data provides a more meaningful analysis.

What is an Asset Turnover Ratio?

An asset turnover ratio is a financial ratio that measures how professionally a company uses its assets to generate sales revenue. It is intended to divide the company’s net sales by the average total assets. The more complex the asset turnover ratio, the more professionally the company uses its assets to generate sales.

The formula for the total asset turnover ratio is:

Total asset turnover ratio = Net sales / Average total assets

For example, if a company has net sales of $100 million and average total assets of $50 million, its asset turnover ratio would be 2.0. This means the company generates $2 in sales for every $1 of assets.

The total asset turnover ratio can be used to compare the efficiency of different companies within the same industry. It can also be used to track the efficiency of a company over time. A declining asset turnover ratio may indicate that the company is not managing its assets as efficiently as possible.

Here are some of the factors that can affect a company’s asset turnover ratio:

- The type of industry the company is in. Some industries, such as retail, tend to have higher asset turnover ratios than others, such as manufacturing.

- The company’s business model. Companies that sell high-margin products or services tend to have higher asset turnover ratios than companies that sell low-margin products or services.

- The company’s management efficiency. Companies with efficient management tend to have higher asset turnover ratios than companies with less efficient management.

The asset turnover ratio is a helpful tool for understanding how efficiently a company uses its assets to generate sales. However, it is essential to remember that the asset turnover ratio is just one efficiency measure. Other factors like profitability and liquidity should also be considered when evaluating a company’s performance.

How to Calculate the Asset Turnover Ratio

To analyze the total asset turnover ratio, you need two critical pieces of information: the net sales or revenue generated by a company and the average total assets held during a specific period. Here’s the formula to calculate the asset turnover ratio:

Total Asset Turnover Ratio = Net Sales / Average Total Assets

Let’s break down the calculation into two steps:

Step 1: Calculate the Average Total Assets

To find the average total assets, you’ll need the total assets at the beginning and end of a specific period, such as a year. Add the total assets at the beginning and end of the period and divide the sum by 2. The formula for average total assets is:

Average Total Assets = (Total Assets at the Beginning of the Period + Total Assets at the End of the Period) / 2

Step 2: Calculate the Asset Turnover Ratio

Once you have the net sales/revenue and average total assets, you can use the formula to calculate the asset turnover ratio:

Total Asset Turnover Ratio = Net Sales / Average Total Assets

For example, let’s say a company has net sales of $500,000 and average total assets of $250,000. Plugging these values into the formula:

Asset Turnover ratio = $500,000 / $250,000

Asset Turnover Ratio = 2

In this example, the asset turnover ratio is 2. It indicates that the company generated $2 in net sales for every $1 of average total assets during the specified period.

How to Interpret the Total Asset Turnover Ratio

The total asset turnover ratio is a financial metric that measures a company’s efficiency in generating sales or revenue from its total assets. It indicates how effectively a company utilizes its assets to generate sales. Here’s how to interpret the asset turnover ratio:

The Efficiency of Asset Utilization

A higher asset turnover ratio generally indicates that a company uses its assets professionally to generate sales. It suggests that the company effectively manages its inventory, property, plant, and equipment to generate revenue.

Comparison to Industry Peers

The asset turnover ratio is best used compared to other companies within the same industry. A higher ratio than industry peers may indicate that the company is more efficient in utilizing its assets than its competitors.

Trend Analysis

It’s essential to analyze the trend of the asset turnover ratio over time. A consistent or increasing ratio suggests that the company is improving its asset utilization and becoming more efficient in generating sales. However, a declining ratio could indicate declining sales or inefficient use of assets.

Variations Between Industries

Different industries have different asset turnover ratios due to variations in business models and asset requirements. Comparing the ratio of a company in one sector to that of another industry may not provide meaningful insights.

Contextual Analysis

Considering the company’s specific circumstances when interpreting the asset turnover ratio is crucial. For example, a company with a high asset turnover ratio but low-profit margins may indicate a high sales volume but lower profitability.

Overall, the asset turnover ratio provides insights into how successfully a company utilizes its assets to generate sales. It is one of the many financial ratios used to assess a company’s operational efficiency and performance.

How to Improve the Asset Turnover Ratio

To progress the asset turnover ratio, you can focus on optimizing the utilization of your company’s assets and increasing sales. Here are some strategies you can implement:

Streamline Inventory Management

Efficient inventory management helps minimize excess inventory and reduce carrying costs. Implement just-in-time inventory systems, regularly review and update inventory levels, and analyze demand patterns to ensure optimal inventory turnover.

Enhance Production Efficiency

Improve production processes to reduce waste, increase productivity, and shorten production cycles. This can involve implementing lean manufacturing principles, investing in technology and automation, and continuously improving operational efficiency.

Optimize Asset Utilization

Regularly assess the utilization of your company’s assets. Identify underutilized or idle assets and find ways to optimize their usage. This may involve redistributing assets across different operations, leasing or renting out unused assets or selling no longer necessary assets.

Improve Sales and Marketing Efforts

Focus on increasing sales through effective marketing strategies, customer relationship management, and targeted sales initiatives. This can include expanding your customer base, improving customer retention, and identifying new market opportunities.

Enhance Supply Chain Management

Collaborate with suppliers and streamline the supply chain to reduce lead times, minimize disruptions, and improve efficiency. This can involve negotiating favourable terms with suppliers, implementing efficient logistics, and optimizing transportation and delivery.

Invest in Employee Training and Development

Prepare employees with the skills and knowledge necessary to improve productivity and operational efficiency. Provide ongoing training programs to enhance employee expertise, encourage innovation, and foster a culture of continuous improvement.

Monitor and Analyze Performance Metrics

Frequently track and analyze key performance indicators (KPIs), including the asset turnover ratio, to identify areas for improvement. Conduct financial analysis and performance reviews to identify trends, pinpoint inefficiencies, and implement appropriate corrective measures.

Remember that improving the asset turnover ratio may require a comprehensive and integrated approach, focusing on various aspects of your business operations. Monitoring and adapting your strategies to ensure long-term success is essential.

Difference Between the Total Asset Turnover Ratio and the Fixed Asset Ratio

The total asset turnover ratio and the fixed asset ratio are two different financial ratios that provide insights into various aspects of a company’s economic performance. Here’s a comparison between the two percentages:

Asset Turnover Ratio

The asset turnover ratio measures the productivity of a secure company using its assets to generate sales or revenue. It shows how effectively the company is using its assets to generate sales.

The formula for the total asset turnover ratio is:

Asset Turnover Ratio = Net Sales / Average Total Assets

The asset turnover ratio considers all types of assets, including fixed assets, current assets, and intangible assets.

Fixed Asset Ratio

The fixed asset ratio, also known as the fixed asset turnover ratio, focuses specifically on utilizing fixed assets (tangible assets with long-term use) in generating sales. It indicates how efficiently a company uses its fixed assets to generate revenue. The formula for the fixed asset ratio is:

Fixed Asset Ratio = Net Sales / Average Fixed Assets

The fixed asset ratio considers only fixed assets, such as property, plant, and equipment, and excludes other asset categories like current and intangible assets.

Conclusion

In conclusion, Total Asset Turnover is a good ratio to assess a company’s efficiency in utilizing its assets to generate revenue. However, it should be combined with other financial ratios and qualitative analysis to understand a company’s performance and prospects comprehensively.